As an independent contractor with Hands N Paws, tracking your work-related mileage is one of the most important things you can do for your taxes. The IRS allows you to deduct these miles, which significantly reduces your taxable income. This guide will walk you through how to use the Timesheet/Mileage feature in Precise Petcare (for tracking your work mileage) and other essentials for mileage tracking.

Why Tracking Mileage is Crucial for You

- Get a Larger Tax Refund (or Owe Less): For the 2025 tax year, the standard mileage rate is 70 cents per mile. This means every 100 miles you drive for work equals a $70 tax deduction.

- It’s an IRS Requirement: The IRS requires a detailed, contemporaneous log (meaning logged at or near the time of the drive) to claim the deduction. A year-end estimate will not be accepted in an audit.

- It’s Your Biggest Work Expense: For most contractors, mileage is their largest work-related expense. Tracking it accurately is key to understanding your true earnings.

The Mileage Deduction: An Either/Or Choice

When it comes to vehicle expenses for your work, the IRS gives you a choice, but you must pick one method. You cannot use both.

- Option 1: The Standard Mileage Rate (Recommended for most)

- What it is: You deduct a set amount for every business mile you drive (the 70 cents/mile for 2025).

- What it includes: This single rate covers all your vehicle costs, including gas, oil changes, maintenance, tires, insurance, and depreciation.

- Who it’s for: This is almost always the best and simplest method for contractors.

- Option 2: The Actual Expense Method

- What it is: You deduct the actual cost of operating your car for work, based on the percentage of miles driven for business. This includes gas, repairs, insurance, registration, lease payments, and depreciation.

- The Catch: This requires you to save every single receipt for all car-related expenses and perform complex calculations. It is generally only beneficial if you drive an expensive vehicle for very low miles.

- Important: If you use the Actual Expense method the first year you use your car for business, you cannot switch to the standard mileage rate in later years.

Our strong recommendation is to use the Standard Mileage Rate. It’s simpler, requires less record-keeping (no saving gas receipts!), and is perfectly suited for the type of driving you do for Hands N Paws.

How to Log Mileage in Precise Petcare

Precise Petcare makes tracking your work mileage simple and automatic. Here’s how to ensure every business mile gets recorded using the clock feature.

Using the Clock Feature for Mileage Tracking

This method lets you track mileage for any purpose, not just scheduled visits, directly from your dashboard.

Step-by-Step Process:

- Start Tracking:

- From any screen in the app, tap the clock symbol (⏱️) in the top right corner.

- A green bubble with a running time will appear, confirming that mileage tracking has started.

- Stop Tracking:

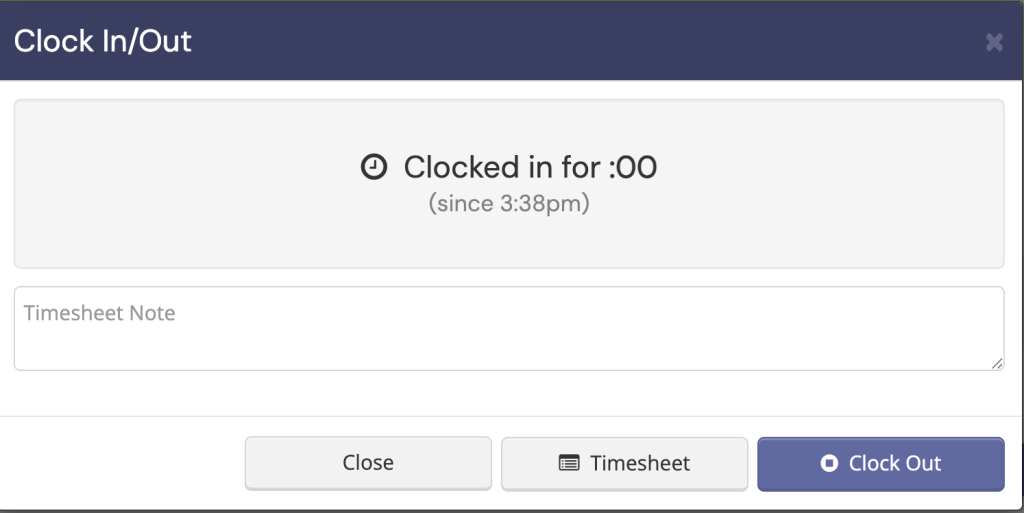

- When you’ve reached your destination, tap the clock symbol (⏱️) again.

- A pop-up window will appear where you can add a note describing the purpose of your trip. See below.

- Click “Clock Out” to finalize and save the mileage entry.

What This Tracks:

This method captures mileage for any work-related driving from the moment you clock in until you clock out. It’s perfect for tracking miles to client visits, supply stores, or any other business-related travel.

Viewing and Managing Your Mileage Log

The Timesheet/Mileage tab acts as your central mileage log.

- View Your Log: You’ll see a list of all your entries, including the date, description, and miles.

- See Totals: The tab will show you total miles for selected periods.

- Edit Entries: If you need to correct an entry, you can typically edit it directly from this list.

Pro Tips for Flawless Mileage Tracking

- Make it a Habit: Clock in and out for every visit. Consistency is key to capturing all your eligible miles.

- Track All Business Miles: Don’t just track visits. Also log miles for:

- Driving to a pet supply store for a client-specific item.

- Trips to the bank for any work-related deposits.

- Driving to a meeting with Hands N Paws management.

- Keep a Simple Backup: While Precise Petcare is a great tool, technology can fail. Use a notepad in your car to jot down your starting and ending odometer readings for the day as a backup. The IRS loves a contemporaneous physical log.

- Understand Your “Commute”: As a contractor with a varying work location, your “commute” rules are different from a traditional employee.

- Deductible: The miles driven from your home to your first client, between clients, and from your last client back home are 100% deductible.

- Not Deductible: Your regular commute from home to a single, fixed workplace is not deductible.

What to Do at Tax Time

- Export Your Data: At the end of the year, go to Timesheet/Mileage > Tools > Export to export a summary of your total work miles.

- Consult a Tax Professional: We strongly recommend working with a qualified tax professional. They can ensure you file correctly and maximize your deductions as a contractor.

By using the Timesheet/Mileage feature consistently, you are protecting your hard-earned income. A few seconds to clock in and out can save you hundreds of dollars at tax time. For more tips/resources, check out this IRS Mileage Guide.